Understanding the Basics of a Reserve Analysis for Your HOA

State laws and/or homeowners association governing documents typically impose duties on homeowners associations relative to the maintenance of reserve accounts. Implicit in these duties is the need for the homeowners association’s board of directors to periodically calculate the estimated reserves that are necessary for the maintenance, repair and replacement of the various components that are incorporated into the association’s common areas and exclusive use common areas that the association is responsible for maintaining. With knowledge of the reserves that are necessary, the association can calculate an existing deficit or shortage in its reserve fund that must be addressed.

A deficit or shortage in an association’s reserve fund is the current unfunded portion of the estimated value of accumulated wear of all major components. For example, if an association has a particular component that has a current value of $10,000 and an estimated useful life of ten years, the estimated annual wear of the component is $1,000. Without factoring in adjustments for inflation, after five years, the component would have an accrued liability of $5,000. An association that is “fully funded” (does not have a deficit or shortage in its reserve fund) would have accumulated $5,000 in its reserve fund for this component by the end of the fifth year. If the association has less than the $5,000 in its reserve account at the end of the five year period, it has a reserve deficit or shortage in an amount equal to the difference.

The basic formula for calculating a reserve deficit or shortage without adjustments for interest and/or inflation is:

Step #1: Calculate the desired current balance for each component by dividing the current cost of each component by the useful life of that component and then multiply the resulting number by the effective age of the component (Current Cost of Component / Useful Life of Component X Effective Age of Component).

Example- If the component in question is a common area roof that has an estimated current cost of $30,000 with a useful life of 15 years and a current effective age of 11 years, the desired current balance to be on deposit in the reserve account is $22,000, calculated as follows:

$30,000 / 15 = $2,000 X 11 = $22,000

Step #2: Subtract the actual amount on deposit in the association’s reserve account for that component from the resulting desired balance.

Example- If the actual amount on deposit in the association’s reserve account for the maintenance, repair and replacement of the common area roof is only $11,000, the current reserve deficit or shortage is $11,000. This association’s reserves are only 50% funded for this component.

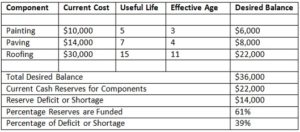

The above two-step process would apply to every component that makes up the association’s common area and the exclusive use common area that the association is responsible for maintaining in order to determine the association’s overall percentage of funding in its reserve account. Thus, the calculation of the percentage that reserves are funded for an association that has components that consist of painting, paving and roofing, would be as follows:

The above analysis will provide an association’s management personnel with estimates for expected reserve expenditures by year for each component included in the analysis. Adding all of the component requirements together provides the association with a rough estimate of the amount of funds that will be required to properly maintain the components over time. The accuracy of these estimates can be improved by factoring in the impact of appreciation that increases the cost of materials and labor, and the interest that accrues on funds held in reserve. Also, it is important to remember that the accuracy of the analysis is dependent upon the accuracy of the data that was used for the initial estimates of replacement costs and the timing of the replacements. Finally, there is a need for periodic adjustments – as the assumptions concerning the remaining life and the cost of components changes over time, they should be periodically reviewed and updated.

It is important for homeowners’ association directors and management personnel to be aware of the mechanics for determining the status of an association’s reserves. Nevertheless, because the actual preparation of a complete reserve study is complicated and requires specialized knowledge and expertise, the actual preparation of a complete reserve study should be performed by independent third-party experts that provide such services for homeowners associations.